Every time I sit with a new prospective client or do a group presentation on retirement, I start with the following two questions: First, “How many of you are currently taking advantage of your employer offered 401k (private/public), 403B (specific for public school educators) or 457 (governmental employees typically police and fire)?” The usual response to this simple question is yes. However, my follow-up question doesn’t typically get the same overwhelming confirmation. The follow-up question: “Do you know how the funds are being invested?” This second question 9 out of 10 times is met with glossy eyes and silence. The truth is everyone knows they should be taking advantage of these type of retirement plans, and most folks are. The unfortunate part is they have little to no concept on how these plans actually work. Well fear no more!

401k’s, 403b’s and 457’s are tax-advantaged, defined-contribution retirement accounts. These plans are considered either as qualified or non-qualified deferred compensation plans. Wow, that sounds complicated. Let’s break if down to a simpler concept. Think of these plans as a vehicle. These vehicles provide tax-deferred growth opportunities on the funds invested. What does tax-deferred mean? Tax-deferred means the owner of the plan (you), do not have to pay taxes on any of the growth within the plans funds until the funds are withdrawn. Also another point to remember is 401ks/403bs/457 have an annual contribution limit currently set at $19,500 by the IRS. It does not matter if you have a 401k & a 403b, you can only contribute a total of $19,500 per year in these types of vehicles. So, if you have both a 401k & a 403B, you have two of the same type of retirement vehicles.

Let’s look at an example:

Over 30 yrs of employment, you invest $10,000 per year/(833 per month) for a total of just under $300,000. This is considered the principal. At a conservative rate of return of 6%, the future account value could be has high as $840,944. This is interested earned on the 300k and has yet to be taxed.

Now, 30 years later you retire and begin to withdraw money in your retirement. The recommended rate of withdraw in retirement is 5%. Why 5%? The account earned 6% over the 30 yrs and can continue to earn that rate of return. Rule to follow for money not to dry out in retirement is to never withdraw more than what you are earning. Some experts recommended a more conservative withdraw rate of 4% to be a “safer” bet. However, for this example we will use 5%. 5% of 841K is $42,050. This annual withdraw puts you by a hair in the 22% tax bracket. (12% tax bracket threshold is currently $40,125 single filer). $9251 will go to the IRS leaving $32,799 in annual income or $2,733 per month. Taxes are a very important concept to always take into account. Remember, in retirement, your tax bracket is dictated by your income, not your age. If you are 80 earning 100k, you will be paying 24% income tax.

Now that you have a better understanding of what 401ks/403bs/457 plans are and how they work, let’s take a look on how they provided opportunities for growth of the principal. Remember I said earlier that these plans are like a vehicle. What powers all vehicles is the engine. The engine of these plans are the underlying investments. Typical investment options within these plans include; Mutual funds, Annuities, Indexes, Individuals Stocks and Money Markets. The type of investment will dictate the overall performance of the plan. NOT ALL ENGINES ARE ALIKE!!!

What do I mean by “Not all engines are alike”? A 401k invested in mutual funds is typically going to outperform Annuities. Not to get overly complicated, Annuities are insurance products. As such, they are more expensive to operate and provided lesser rates of return than other engine types. Investing in Indexes (S&P 500, NASDAQ 100, etc) will on the norm out perform all of these options as stand alone investments. Individual stocks can be very productive but equally volatile based on that individual companies financial outlook. Finally, Money Markets are a very small step above savings accounts and CD’s (Certificates of Deposit) at a bank, and those are HORRIBLE!!

Additionally, how your 401k/403b/457 portfolio is constructed will also impact it’s overall rate of return. What do I mean by how the portfolio is constructed? Some less than scrupulous agents (most of the ones that visit school’s teacher lounges) will sell you on the idea that you need to be “diversified” in order to better protect yourself from market fluctuations. Folks, the market is going to up and down. It has in it’s 100 year history. In an effort to convince you on diversification, they will sell you a cookie cutter portfolio consisting with as many as 15 different mutual funds as the engine of your plan. More funds equals more fees, more fees translates to a lesser overall rate of return due to the inefficient construction of the portfolio. Worse yet, some of these same agents will sell you on an Annuity for your engine. Annuities have there place, but are better suited for large lump sums not efficient growth. That’s a whole another topic.

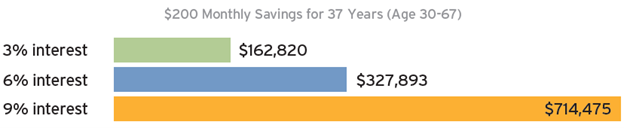

Understanding what investment engine and the is powering your 401K and what rate of return is producing is absolutely critical. Why is this so critical? Let’s look at the example below:

Here you can clearly see the power of compounding interest over time. Everyone needs to understand rates of return. The engine you choose for your 401k/403b/457 will determine it’s potential. I often hear the following complaint, “my 401k isn’t producing anything”. It’s not the 401k. It’s the type of engine. Once again, the unfortunate circumstances with these plans is you the consumer/investor were either given very little guidance by your employer about the plan options or what happens to many teachers, you were sold a less than desirable plan in the teachers lounge by a rep of XYZ company promising the world. In both cases, you think you might be on track until you meet someone like me that provides the education you so desired but never knew where to find it.

Want to know what you have, how it’s working (or not) and better options if applicable in a hassle free, no fees (hidden or otherwise) fashion? Please contact me via email at Louis@louisromero.com and I will be happy to help.