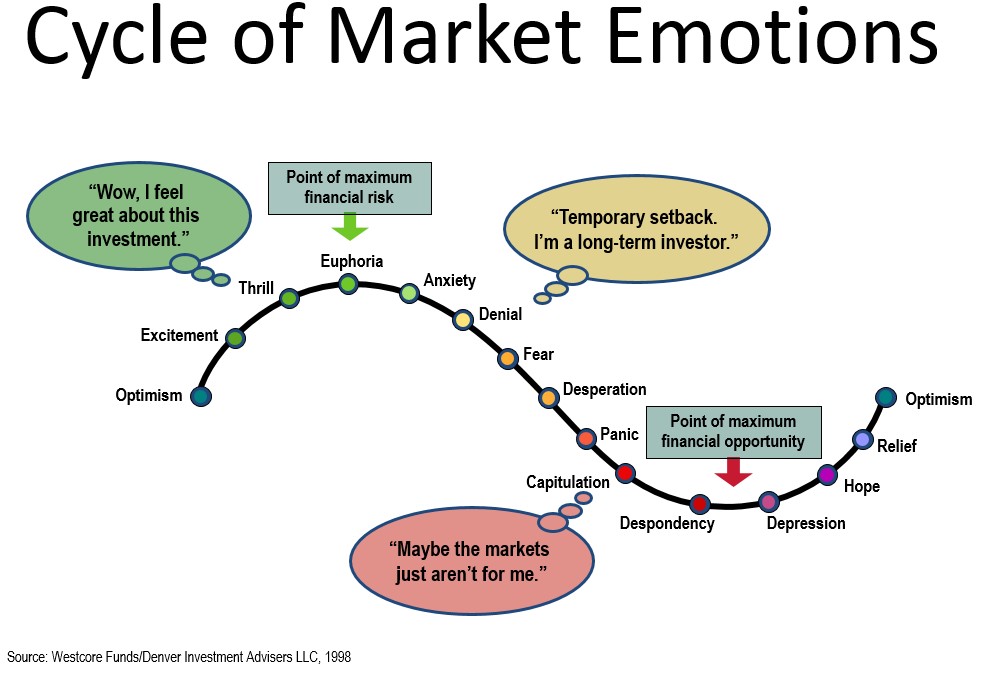

The market has been significantly volatile since the beginning of 2022. Global events has ignited the rollercoaster ride for investors. The War in Ukraine, the unpredictability of Oil Prices and Inflation on a roll have all had a major impact on market performance. Depending on which expert you listen to, things are going to be great or there is another recession on the horizon. The facts of the matter are, no one really knows or can predict what exactly is going to happen. We can only use historical events to gauge and plot possible outcomes. Throughout history, some of the best market performances have followed market crashes. The kicker is, no one knows how long each Bull or Bear market will last. It’s important to remember that the market response to both negative and positives aspects of worldly events, this is normal. For this reason, it very important to remember the “Cycle of Market Emotions”.

Its extremely essential to have a solid plan of action, a strategy, in place and maintain the wherewithal to stay the course in the good times and in the bad times. To easily remember, what this strategy should be, we use the 3 D’s of investing. Discipline, Dollar-Cost Averaging and Diversification.

Dollar-Cost Averaging

Simply stated, Dollar-Cost Averaging is systematically investing an amount in regular intervals, example monthly or quarterly. You can’t predict when the market will drop or rise. However, if you are investing on a regular set schedule, you will benefit from purchasing shares when markets are down (more shares acquired for the same investment amount) or when markets are up (less shares for the same investment amount). Steady, constant investing over time regardless of market conditions removes the potential for emotions to interfere.

Discipline

Staying focused on your investment goals is paramount. Too many investors are happy when the market is up and depressed when markets are down. These emotions are actually the inverse of what they should be feeling. Think of it this way, when the market is down, the market is on “Sale”. That investment you were considering might be 10,15 or even 20% off the original purchase price you were considering before the market dipped. That’s a good thing. When the market is up, think of the market as being “Overpriced”. That same stock you were considering might be 10,15 or even 20% at a premium of when you first considered purchasing. For this reason, maintaining investment discipline is important. Never get to high or to low and most of all don’t panic!

Diversification

By investing not only in mutual funds which inherently provide diversification, investing across different asset classes provides additional downturn protection. This may also increase gains. Remember, because one sector of the market might be suffering, other sectors of the market might be thriving. A perfect example of this concept now during the COVID-19 pandemic is the travel and hospitality sector versus the technology sector. The restaurant and travel industry have been taking a beating with the recommended restrictions. At the same time, technology based companies such as Zoom have taken off. Having a diverse portfolio, investing across different asset classes can be advantageous.

These are the recommended 3 D’s of investing. If you would like a more personalized model for your investment needs, please contact me directly at Louis@louisromero.com.